We have established that operating a residential rental property is a business, whether passive or active in nature. Here’s what you need to know about how and by whom your profits will be taxed:

Taxes Based on Your Gross Rental Income

These are taxes applied to the amount of income you received BEFORE you deduct any expenses. Generally, these taxes are due frequently, once or twice per month.

In my state, these taxes only apply to short-term rentals. Short-term rentals are considered rental stays of 30 days or less. Long-term rentals are generally not subject to sales taxes or occupancy taxes. Be sure to check how your state and locality handle this.

Sales Taxes – Depending on your state, the income from a short-term rental, like an Airbnb, most likely will be subject to sales tax. Therefore, make sure you add this tax on top of your rental fee and remit to the state and local jurisdiction as applicable. Generally, sales taxes will be remitted once per month.

Lodging or Occupancy Taxes – Many local jurisdictions will also charge a local rate to all income subject to the state’s sales tax.

Services such as Airbnb and VRBO may collect and remit these taxes for you. It is essential to understand what taxes each of your properties is subject to and who is remitting the payment.

Taxes Based on Your Net Rental Income

These taxes are applied to the amount of income you received AFTER you deduct all of your business expenses. You report them annually on your federal and state income tax returns, and the taxes apply to both short-term and long-term rentals.

- Income Taxes

- Federal income tax rates generally range from 10 to 37%. Rental profit is treated as ordinary income and taxed the same way as other income (atop the highest tax bracket you are subject to).

- State income tax rates vary from 0 to 13% and are in addition to the rate of tax you pay the federal government. Your rental income will be taxed by the state in which your property is located.

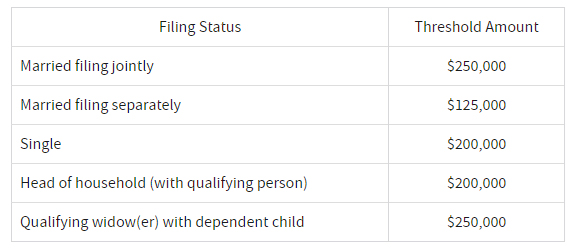

- Net Investment Income Tax

- If your rental income is considered passive income and if your modified adjusted gross income is above thresholds set by the IRS (see below), your rental income is subject to this additional tax at a 3.8% rate.

- Self-Employment Tax

- The self-employment tax rate is 15.3%. The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance).

- Self-employment tax is only applied to active income. This tax only applies if you are considered a real estate professional and you consider your rental income as active income.

- No one is subject to both the Net Investment Income Tax and self-employment tax. The prior is applied to passive rental income, and the latter is applied to active rental income. It is important to understand which applies to your situation. In most cases, rental income is considered passive income.

Taxes Based on Your Property’s Current Fair Market Value

Property tax is paid for all real property no matter how it is being used to generate income.

- Property Tax – This is an annual tax that will assessed by the county in which the residential rental is located.

Knowledge is Power

At the end of the day, the federal government as well as your respective state, city and county governments will get a piece of your pie. But keep in mind, knowledge is power.

With our ROI Booster report, we help you ward off some taxes, so you can keep more profit in your bank account. Read our next blog “Tax Breaks for Your Residential Rental” to learn how.

Income and Expense for Residential Rental Endeavors

Income and Expense for Residential Rental Endeavors

Leave a Reply