How the Residential ROI Booster Works

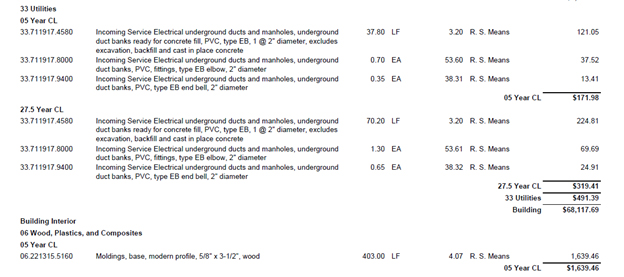

The Residential ROI Booster takes the information you provide about your property, crunches it through construction and building value databases, and exports a report that essentially “reverse engineers” your property on paper. Each component of your property is listed and assigned a dollar value, the total of which will be your purchase or construction cost. It looks like this:

The multi-page report assigns a value to all visible and non-visible components in your structure. Components include everything in your home, from the roof to the foundation and everything in between.

By default, your rental is depreciated over 27.5 years if it is a long-term rental and over 39 years if it is a short-term rental (rented for less than 30 days at a time). That is a long time! The IRS allows you to depreciate specific portions of your property more rapidly (sometimes immediately) but determining which components those are and what value they are assigned is key.

Simultaneously and most importantly, the report will identify items in your home that can be expensed as depreciation more rapidly and sometimes immediately. These are items that are allowed by the IRS to have a shorter depreciable life than a single long-life building. This identification is the driver of your resulting tax savings.

We’re Rule Followers

As you can imagine, the IRS has strict rules and guidelines for determining these two factors. We won’t get into the details here, but with 80+ years’ experience in this field, you can be confident that our team strictly follows all IRS rules and guidelines. We also provide an audit guarantee, so if the IRS ever questions your report, we will defend our results until resolution.

Reaping the Benefits of the Residential ROI Booster

This entire process has been utilized for commercial properties for 30+ years. Residential properties did not previously utilize this technique for expense acceleration because of the cost required to get a breakout study performed. Until now.

Seeing a need to allow smaller properties, primarily residential rentals, to also benefit from this tax planning technique, we developed the automated report generator by utilizing the information and knowledge we gathered from manually performing thousands of these studies.

What are the Benefits of Accelerating My Depreciation?

What are the Benefits of Accelerating My Depreciation?

Leave a Reply