Everyone struggles with this question. Appraisers, owners and government officials alike find it difficult to separate the value of land from the structures sitting on the land.

When you buy property, you often don’t consider that you are actually purchasing the land and the structures as two distinct items even though you most likely know that land in New York City or on Miami Beach is worth a lot more than the structures sitting on these parcels.

Land Is Not a Depreciable Asset

The IRS does not allow owners to depreciate land in any way. Land is considered an asset that only appreciates in value; however, the structures on the land do not last indefinitely. At some point in time, they will deteriorate and eventually collapse if not maintained. You’ve seen old, abandoned barns or houses, left to the elements, eventually crumble, yet the land on which they sit stays the same.

Determining Land vs. Residence Value

Now that we understand why the land and its structures are distinct items, let’s discuss how you determine the land vs. residence value. First, you need to establish if you have an appraisal of your property that mentions or determines land value. Although this is uncommon, it’s possible it was in your appraisal when you purchased your property.

If you cannot locate any information of value in your appraisal, check the county’s tax assessment on your property. Each county has a breakout of land and building structures. Your latest property tax bill should include this breakout. If it doesn’t, call your county to secure the amount.

A Straightforward Formula

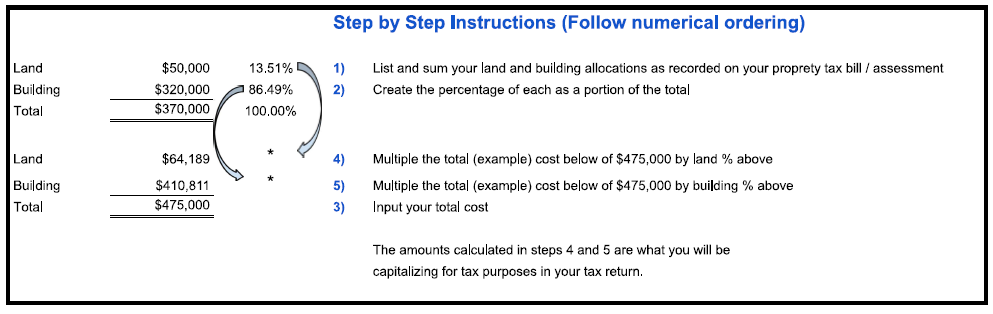

Do realize the breakout you see on your property tax assessment often does not match the total amount you paid for the property. If this is the case, you need to calculate the relative percentage of land to building from the county’s numbers and apply it to the total cost.

The formula looks like this:

Ready for Your Tax Return

Bingo! You now have an amount you can record on your tax return for land (non-depreciable) and buildings (depreciable). The IRS generally accepts this technique. Save the calculation you created above to document how you determined your amounts, in the unlikely event of a future audit.

Determining the Cost Basis of Your Residential Rental Property

Determining the Cost Basis of Your Residential Rental Property

Leave a Reply