Many people fall into the role of landlord by accident. Perhaps you inherited a property, or you married and both you and your spouse own a home. People finding themselves with multiple properties often choose to live in one and either sell or rent the second property. People also enter into the world of real estate investing because it is a preferred alternative to investing in the stock market, offering the ultimate in diversification. No matter how you became a landlord, understanding the operational side of this business is essential.

Profit and Loss Statement

In the accounting and finance world, the profit and loss statement (P&L) summarizes your business’s activity and reports income less expenses. The P&L is calculated for any chosen period of time, for example, one month, one quarter or one year. For income tax reporting purposes, the IRS requires you to report your business’s income and loss based on one full year. For business analytics, you can look at your P&L based on different time periods.

The Balance Sheet

The balance sheet is the other major accounting report you generate for your business. The balance sheet presents assets your business owns less items your business owes, such as loans, and is always shown as one day in time. This is the same concept as calculating your net worth as an individual at any point in time.

The balance sheet answers this question: If you were to sell or liquidate your business today, how much money would you get out of this business? This is calculated by looking at the amount of cash in the bank today in comparison to the worth of the property, reduced by the amount owed on the mortgage.

Assets and Liability

To illustrate this particular concept, let’s return to my family’s vacation rental property:

We have a piece of property we plan to rent for profit. This property cost us a certain amount to purchase. The cost represents the major asset in our business. Using the original purchase price, we record the asset on the asset side of our balance sheet.

Now for the liability side. We record any mortgage or loan we have on the property in the liability section of the balance sheet. The net of the asset minus the loan is the equity we have in the property.

Read our blog “How Much of My Cost Is for Land vs. Residence?” before recording your purchase on your balance sheet.

Time to Make Money

Next, we start renting our property and use the asset to make money. Rental income is our profit and is recorded on the P&L. Of course, we have expenses associated with operating the rental—whether it’s hiring a plumber or an electrician or paying property taxes. Therefore, we record all costs of being a landlord as expenses, which reduces our profit. We easily track these expenses by saving receipts when the service or items are paid.

The P&L: Predicting Returns

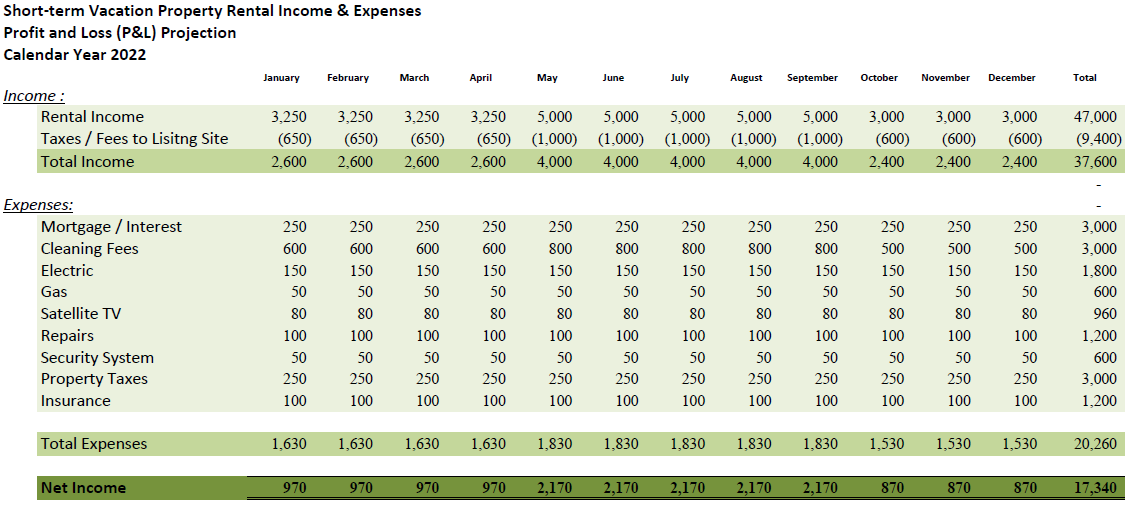

Let’s take a closer look at the P&L. We plan to rent the property on a short-term basis using Airbnb and VRBO. Look at our estimated, budgeted activity on the following P&L:

If we achieve the net income annual goal of $17,340, our return on investment (ROI) is 5%. We calculate the ROI as the annual net income over the cost of the residence, which in this case is $380,000. We hope to annually earn a 5% return on our money from this investment.

ROI Booster: Increasing Returns

We will also plan to use the ROI Booster report to boost this return from 5% to a higher amount. Go to the blog “ROI Booster Results Applied to My Vacation Rental Property” to find details about the report and see the results of our boost!

Residential Rental: From Concept to Operation

Want to learn more? Our blogs follow this vacation property from concept to operation. Walk through how we built the property, how we set it up for renters and how we now attract renters. Then, review our initial budget to actual results to discover our successes and failures.

Use our experience as your resource!

Melinda and James Saved over $28,000

Melinda and James Saved over $28,000

Leave a Reply