You will need essentially three or four pieces of information at the ready before you begin the report process. Detailed explanations of what’s needed is listed below, so you can gather materials before starting. Once you’re ready, the actual report should take less than 15 minutes to generate.

For properties purchased or constructed in the current tax year

Start here if:

- you purchased real estate last year and have not filed your tax return for last year yet

- you purchased real estate in the current calendar year and will report the new asset on your tax return next year

Here’s what you need:

- Original purchase price or total construction cost

- See our blog Determining the Cost Basis of Your Residential Rental Property for specifics on how you determine this amount.

- Land value

- See our blog How Much of My Cost Is for Land vs. Residence? to secure this number.

- Purchase Date or Construction Completion Date

- Available For Rent Date

For properties purchased or constructed in a prior tax year

Start here:

- if you have already capitalized and started depreciating your residential rental in a prior tax return

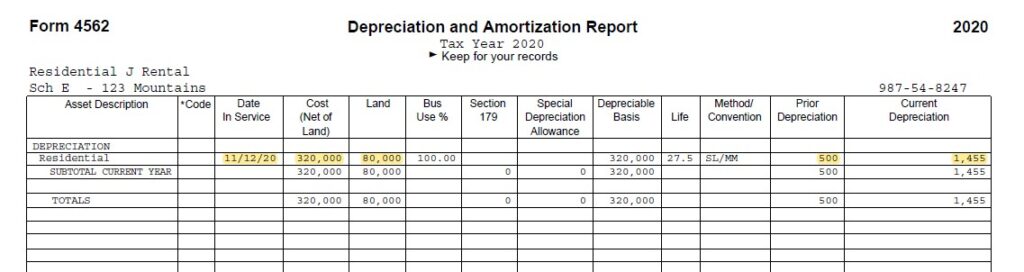

Go to your last filed tax return and locate the depreciation schedule generated with your return. In the example below, we are preparing our 2021 tax return, so we use our 2020 depreciation schedule from our last filed tax return.

It will look like this:

Here’s what you need:

- Date in service

- This is the date available for rent. If your purchase date is different than the date you first made the property available for rent, you will also need the purchase date handy to input in the system.

- Capitalized cost (net of land) of the residential real estate. Your residential rental should also have a life of 27.5 years like the residence shown in the example above.

- Land value

- Add together the numbers shown in the prior depreciation and the current depreciation columns. This sum will be a single input into the prior depreciation box in the report (This is due to the fact that the current depreciation last year is now prior this year).

If we are generating a report for a residential rental that you purchased or constructed in a prior tax year and you’re currently under audit by the IRS, we need to know this information.

In this case, we will generate Form 3115 for you. You will need to take your results to your tax preparer, so he or she can fill out that form correctly in conjunction with your current audit. Now you know exactly what information you need, let’s get started!

Does It Matter When I Bought My Property?

Does It Matter When I Bought My Property?

Very interesting content. Thanks for sharing.